OP-Mainnet

Key Takeaways

- OP-Mainnet is an optimistic rollup solution that scales Ethereum by moving computation and state storage off-chain.

- The economics of OP-Mainnet include revenue and cost estimates for both on-chain and off-chain operations.

- Holding assets for OP-Mainnet include Base Fee, L1 Fee Vault, and Sequencer.

1. Overview

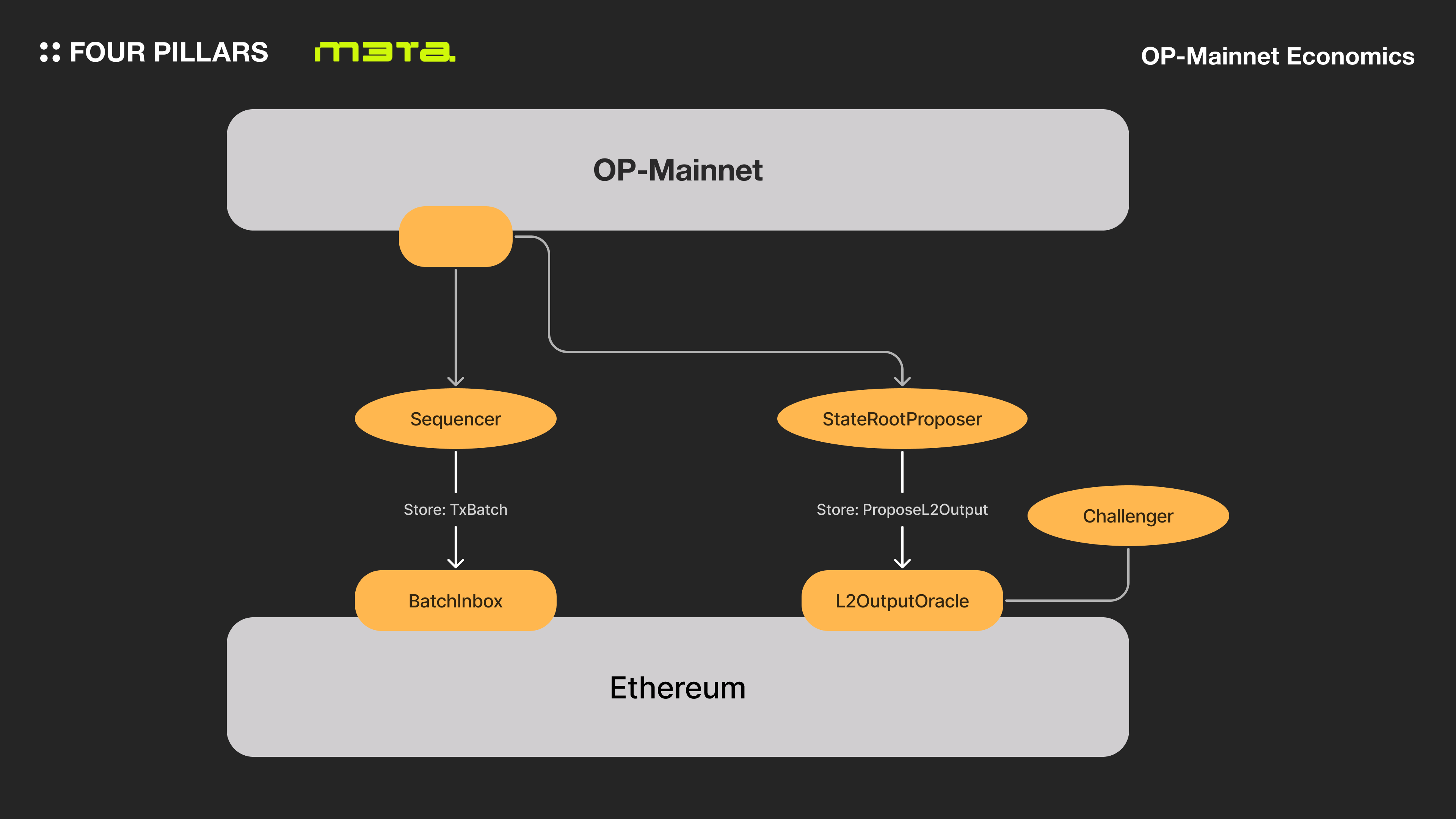

OP-Mainnet is an optimistic rollup solution designed to scale Ethereum. It moves computation and state storage off-chain, reducing gas costs for users. Unlike other scaling solutions like sidechains or plasma chains, OP Mainnet derives its security from the Ethereum Mainnet by publishing transaction results on-chain. This ensures that the native security of Ethereum secures the broadcasted information. Also, as the state root changes in OP-Mainnet, it updates the change to the L2OutputOracle contract in Ethereum.

This makes the input and output data available in Ethereum, allowing challengers to contest whether the computation was performed without error.

Learn More about the architecture at “Architecture of OP-Stack”

2. Economics

2.1 Revenue & Cost (On-Chain)

Source: Modular Economics | M3TA

2.1.1 Revenue

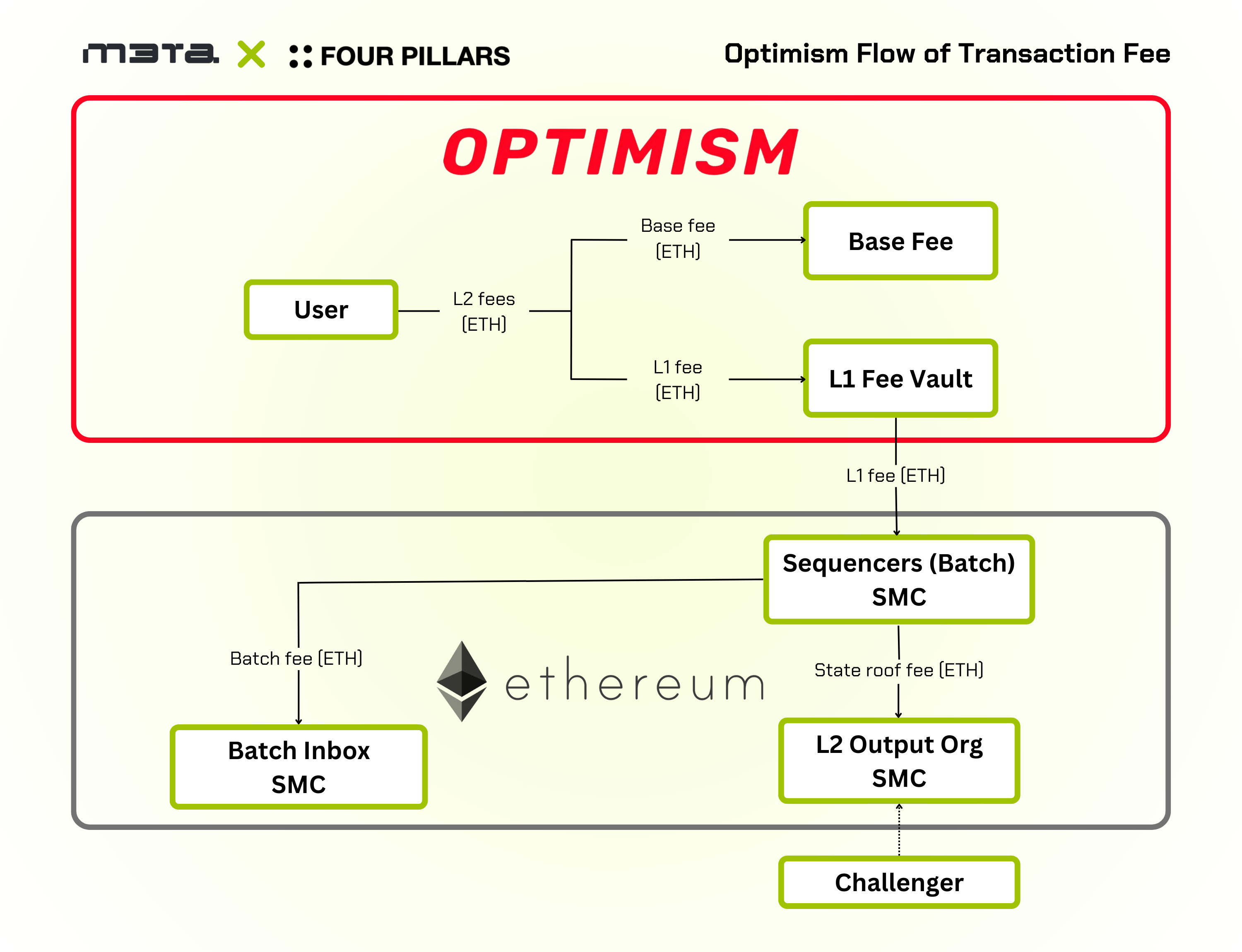

- L2 Transaction Revenue: In Optimism blockchain, transactions have L2 (execution) and L1 (security) fees. L2 fee is the cost of executing the transaction, calculated by multiplying the gas used by the gas price. L1 fee is the cost of submitting the transaction to Ethereum, calculated based on Ethereum's gas price. Optimistic rollups use a gas fee scheme similar to Ethereum, with fees depending on L2 operator fees and L1 data fee.

- L1 Fee profit from L1 users trying to initate a transaction to L2

2.1.2 Cost

- Storage Cost: The storage costs for OP-Mainnet include storage batch storage cost, and StateRoot storage cost. Batch storage cost is the cost of storing transaction batches to Ethereum's

BatchInboxAddress. StateRoot storage cost is the cost of storing State Root data in Ethereum'sL2OutputOracleContract. - Challenge Cost: The cost of re-executing transactions and identifying errors in the results is currently centralized and rarely invoked.

2.2 Revenue & Cost (Off-Chain)

2.2.1 Revenue

- Ecosystem Fee: OP-Mainnet's primary codebase, "OP-Stack Framework," is currently open-sourced and can be used to launch a L2 chain. This has resulted in several projects utilizing the OP-Stack codebase. These forks are not obligated to share revenue with OP-Mainnet. However, Base has recently announced that they will share their profits with OP-Mainnet.

- OP Token: OP-Mainnet has its own token, but its current utility is limited to governance and it is not used as a network gas token. Nonetheless, the token issuance has generated a new revenue source for OP-Mainnet, which is used to fund projects that can help the OP-Stack ecosystem flourish.

2.2.2 Cost

- Sequencer Operating Cost

- Developer Cost

- Core Infrastructure

- Sub-Infrastructure: Wallets, Explorer,

3. Analysis

3.1 Cumulative Profits

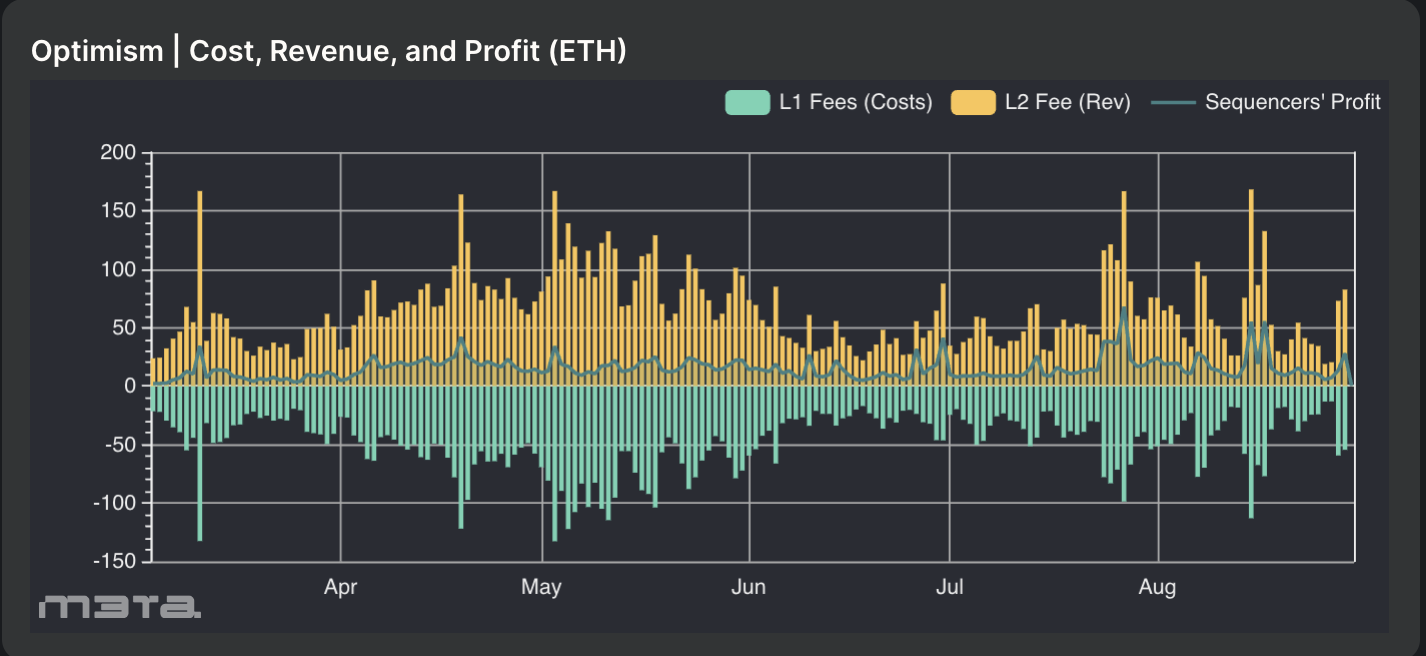

Source: Modular Economics | M3TA

According to the on-chain data, OP-Mainnet has been very profitable.

3.2 Transaction Fee Breakdown

Source: Modular Economics | M3TA

Based on the total “L2 Transaction Fee Revenue”, the above graph show how much cost it has been used in the recent operation. In here, it can be observed that most of the cost comes from “L1 Tx Batch Fee”